The Gold Monetization Scheme is an initiative to let households earn money by putting their idle gold to good use. This scheme was launched on November 5 and has already become very popular. Gold is a valuable asset, and if you have idle gold, you can use it to earn interest.

This scheme will benefit the government as well. By circulating gold throughout the country, the scheme will reduce the need to import gold, keeping the country’s money within the country.

What Deposits Are Allowed Under the Scheme?

- A depositor can choose the term of deposit as per their convenience.

- Depositors can choose short, medium, or long terms.

- Short term: 1-3 years.

- Medium-term: 5-7 years.

- Long-term: 12-15 years.

- Banks can take short-term deposits on their own authority.

- Banks can take medium and long-term deposits only on behalf of the government, and only when the RBI notifies.

- Depositors can deposit raw gold, which includes coins, bars, biscuits, or jewelry.

Who is Eligible for the Gold Monetization Scheme?

Any person who is a resident of India and holds valid Indian ID proof can deposit gold under the Gold Monetization Scheme.

- Individuals: Resident Indian citizens.

- Hindu Undivided Families (HUFs).

Business entities:

- Proprietorship firms.

- Partnership firms.

- Companies.

Trusts:

- Charitable trusts.

- Exchange-traded funds (ETFs) and mutual funds registered under SEBI regulations.

Government: Central and state governments, or any entities they own.

What are the Benefits of the Gold Monetization Scheme?

- You can increase your savings without making any new investments. Simply deposit the gold you already own in a bank locker.

- Individuals can earn money by putting their idle gold to use.

- By reducing gold imports, you will help in developing the country to some extent.

- Unlike other schemes, you can withdraw your investments when needed. If you are in need, you can withdraw the gold from the bank.

- Banks accept a minimum of 30 grams of gold, so even if you don’t have much gold to invest, you can still benefit from the scheme.

- Another scheme for the development of the country is Saansad Adarsh Gram Yojana.

What is the Rate of Interest for Depositors?

Depending on certain factors, the rate of interest will range between 2.25% and 2.50% per annum. This is higher than the previous rates of interest offered by the government on various savings deposit accounts.

| Sr. No. | Type of Deposit | Duration | Minimum Lock-in Period | Applicable Interest Rate | Periodicity of Interest Payment |

| i. | Short Term Bank Deposit (STBD) | 1-3 years | As determined by banks | As determined by banks | As determined by banks |

| ii. | Medium Term Government Deposit (MTGD) | 5-7 years | 3 years | 2.25% p.a. | Simple Interest annually or cumulative interest at the time of maturity compounded annually. |

| iii. | Long Term Government Deposit (LTGD) | 12-15 years | 5 years | 2.50% p.a. | Simple Interest annually or cumulative interest at time of maturity compounded annually. |

Purpose of the Gold Monetization Scheme from the Government’s Point of View

The Gold Monetization Scheme will reduce gold imports. Indians have enough gold in their lockers, but they do not wear it daily. When new demands for gold arise, jewelers need raw gold, and if the country doesn’t have it, it must be imported.

Banks can give the gold deposited under the Gold Monetization Scheme to the RBI for minting new coins. MMTC can also take the gold and pay some interest on it. In this way, it is an initiative for nation-building, circulating gold within the country, and reducing the need for imports.

Can I Deposit Any Type of Jewelry Under the Scheme?

Most Indians have gold in the form of jewelry. Jewelry with embedded stones will not be accepted. The accepted fineness of gold is 995. If your gold is not of 995 fineness, the bank may not accept it.

How to Apply for the Gold Monetization Scheme

- Visit the nearest bank branch and inquire about opening a gold deposit account.

- If depositing gold for a short period, the bank will allow it without further proceedings. For longer durations, wait for an RBI notification.

- Open a metal account in the bank and bring the physical gold for deposit. The bank agent will check the purity and credit your account with the gold’s value.

- Bring KYC documents for safety. The bank can lend the deposited gold to jewelers at a higher rate than the interest you receive.

How Does the Gold Monetization Scheme Work?

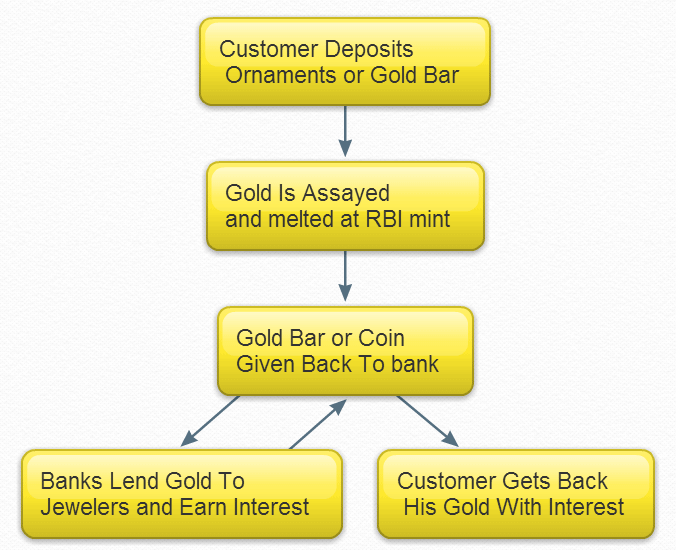

Depositors open a metal account in the bank. After verifying the purity of the gold, the bank credits the account with the gold’s value. The bank can lend the gold to jewelers, earning money and paying you interest. This reduces the need for gold imports, improving the country’s economy.

Points to Keep in Mind About the Gold Monetization Scheme

- Banks accept as little as 30 grams of raw gold.

- Various forms of gold are accepted, including coins, bars, and jewelry.

- There is no upper limit on the deposit.

- There is a lock-in period, but after that, depositors can withdraw the gold, though a penalty may apply.

- All commercial banks can implement the scheme.

- The interest rate for depositors is 2.5% per annum, higher than other government gold deposit schemes.

- At redemption, short-term depositors can choose either money or gold as interest.

Let us know your opinion about the scheme in the comments section below.